EQT's securities investment development prospects in the market in Vietnam 2024

2024-08-27

GDP growth in the first 6 months of 2024 reached 6.42%

According to information in Resolution 108/NQ-CP dated July 10, 2024 on the regular Government meeting in June 2024 and the Government's online conference with localities, a number of economic indicators (including GDP index) in the first 6 months of 2024 achieved as follows:

Vietnam's socio-economic situation in June, the second quarter and 6 months of 2024 clearly shows a positive recovery, the following month is better than the previous month, the following quarter is higher than the previous quarter; Achieved many important results, better than the same period in 2023 in most fields, creating a foundation to strive to complete and exceed the socio-economic development goals of the whole year 2024.

Also according to the content of Resolution 108/NQ-CP dated July 10, 2024, the macroeconomy continues to be stable, inflation is controlled, major balances of the economy and social security are guaranteed.. The 06-month consumer price index (CPI) increased by 4.08%, core inflation increased by 2.75%. The currency market and exchange rate are basically stable; The economy's credit growth reached 6%; Security of credit institutions is guaranteed. State budget revenue in 6 months reached 60% of the estimate, an increase of 15.7% over the same period while promulgating many fiscal policy solutions, exempting, reducing, and extending taxes, fees, and fees to support people. people and businesses with a scale of about 160.5 trillion VND; Public debt, government debt, foreign debt of the country, and state budget overspending are well controlled within the targets assigned by the National Assembly.

Total social investment capital in the second quarter increased by 7.5% over the same period, and overall for 06 months increased by 6.8%. Disbursement of Convention investment capital reached 29.39% of the assigned plan. Foreign direct investment (FDI) registered in 6 months reached nearly 15.2 billion USD, an increase of 13.1% over the same period; Realized FDI capital reached about 10.8 billion USD, an increase of 8.2%. Total export and import turnover of goods in 6 months increased by 15.7%; Trade surplus is 11.63 billion USD. Remaining issues and obstacles continue to be focused on resolving; Management of gold, petroleum, electricity markets... Positive change.

The main industries and sectors of the economy are growing well. The 6-month industrial added value increased by 7.54% over the same period, of which the processing and manufacturing industry increased by 8.67%. The Purchasing Managers Index (PMI) in June reached 54.7 points, the highest since 2020. Agriculture develops stably, continuing to affirm its role as a pillar of the economy and ensuring national food security. Total retail sales of goods and consumer service revenue in 06 months increased by 8.6% over the same period. Tourism recovered strongly; 6 months reached 8.8 million visitors, an increase of 58.4% over the same period in 2023 and an increase of 4.1% over the same period in 2019 before the COVID-19 pandemic. Business development with positive trends; In total, in 06 months, nearly 120 thousand businesses were newly established and returned to operation. Many international organizations highly appreciate Vietnam's economic growth results and prospects.

Among the organizations that give good assessments of the growth of the Vietnamese market is EQT VN. Until the beginning of 2024, expert Do Quang Khai was assigned by EQT VN Investment Fund to move the headquarters of EQT Asia from Hong Kong to Vietnam in an effort to develop the Vietnamese market. This series of investment projects is "Vietnam worthy of Asia finance" chaired by expert Do Quang Khai and has been supported by Vietnamese investors.

Information about experts

CG.Do Quang Khai-CEO of EQT Asia

Mr. Do Quang Khai was born in 1972 in Hoan Kiem District-Hanoi. This is the leading political and economic center city in Vietnam. Always at the forefront of finance, culture, media, educational research and transportation. With its special geographical location, Hanoi has also become the most vibrant city.

Mr. Do Quang Khai was born in 1972 in Hoan Kiem District-Hanoi. This is the leading political and economic center city in Vietnam. Always at the forefront of finance, culture, media, educational research and transportation. With its special geographical location, Hanoi has also become the most vibrant city.

Mr. Do Quang Khai's father is a former economics lecturer at Hanoi University of Economics (Hanoi National University), his mother is the CEO of a large British financial group in Vietnam. In Mr. Do Quang Khai's memory, what he remembers most is the image of his parents when and it made him always enjoy investing in stocks. The topic that his parents talk about the most every day is also the topic of stock investment. Influenced by his parents, he imbibed the concept of stock investment from a very young age. After graduating from high school, Mr. Do Quang Khai excellently passed the entrance exam at Hanoi University of Economics, and graduated with a master's degree in economics in 1999. After graduating, he followed his father's advice and went to the United States to continue his master's degree in economics and finance at the University of Pennsylvania (UPenn) in 2000, followed by moving to the University of Minnesota to study finance in 2004.

After obtaining his PhD in 2007, he returned to Vietnam to live to take care of his parents for a year, then returned to the United States at the end of 2008, at which time he was introduced by his classmates and became acquainted with Bill H. Gross as well as participated in forums and seminars shared by Bill H. Gross. After the process of acquaintance and exchange, many things have been learned. Summarize the quintessence learned to find the key points in transactions, in investment activities that are not simply transactions but also his vision. When researching macroeconomics, he has a very unique vision of Vietnam's macroeconomics. For the Vietnamese economy he has a very unique perspective, after his studies he successfully joined the stock investment department of the world's leading fund EQT in early 2009 as an analyst.

From the end of 2008, he moved to EQT's headquarters in Asia, opening offices in Singapore and Hong Kong. In Hong Kong as a securities investment advisor, during his 7 years at EQT, he applied his professional knowledge, accumulated personal relationships and internal information of the company to accumulate nearly US $30 million after 7 years of investment. Basically achieve financial freedom. Currently holding the position of CEO of EQT Asia Pacific headquarters (Vietnam market management branch), mainly working in the Vietnamese market.

Achieving financial freedom at the age of 48 is too difficult, and the chance ratio for people at the same age to do this is only less than 1/12 000. The results of everything are going very smoothly thanks to Mr. Do Quang Khai's own efforts and the cooperation of the market, more importantly, Mr. Do Quang Khai has chosen the right direction, from his own efforts plus the right choice, Mr. Do Quang Khai has achieved his life goal 10 years earlier than expected.

This time, when trying to enter the Vietnamese market, Mr. Do Quang Khai will take advantage of his close relationships and extensive work experience to successfully complete the set work goals. The success of the first phase of "Vietnam worthy of Asia's finance" has brought great personal prestige to Mr. Do Quang Khai, and related work for the second phase currently 2024 is being prepared.

In addition, in this plan, there is not only independent support from Mr. Do Quang Khai, but he also trained a team of assistants with extensive experience and especially good in-depth knowledge to ensure EQT Vietnam's support to all investors.

In the near future, continuing with the companionship of EQT Vietnam, Vietnam's investor support plan (2024) directly implemented by CG. Do Quang Khai as well as an investment information group led by experts. Expected to bring a "wave of profits" to retail investors in Vietnam, they can confidently win in the Vietnam stock investment market 2024.

Information about EQT VN Financial Investment Fund

EQT focuses on healthcare, technology, services and industrial technology as core sectors. Focus human resources with deep investment expertise, industry and sector knowledge, and extensive networks in the world business community and activity group associations. With a strong approach by sector and by maintaining a local presence with local people, the group is uniquely positioned to analyse the companies and markets in which they operate and develop exclusive investment opportunities.

The fund's operational approach is combined with a clear EQT perspective for each investment to leverage the strengths of the EQT platform to drive growth, industry consolidation, structural change, and sustainability and digitalization leadership. These are some of the main advantages when evaluating investment opportunities and monitoring the development of companies in the portfolio.

* Data milestone: Capitalization of 1 billion USD; 44 companies in the portfolio; 110 investment consultants;

EQT VN is currently cooperating with many leading businesses and organizations in Vietnam

EQT Vietnam Formation Facility

Since 1992, with the rise of the Asian economy, along with most multinational companies and financial corporations have begun to develop business in Asia. To expand the market in Asia, an Asian headquarters was opened in Hong Kong to be responsible for business in Asian countries such as China, Korea and Japan.

However, since 2020, political unrest has occurred in Hong Kong. Due to Hong Kong's liberal policy, it has been challenged by the Chinese government, and at the same time, the outbreak of (Covid-19) has made foreign-owned enterprises operating in China difficult and increasingly challenged by the Chinese government's supervision. More and more multinational companies are moving their headquarters out of Hong Kong. EQT VN is preparing to move its Asian headquarters to Vietnam.

Since January 2024, the Investment Management Department under EQT VN's Asia-Pacific regional headquarters has actively contacted Vietnamese financial institutions, regularly contacting the Exchange. Vietnam Securities and contact major asset management companies in Vietnam.

To attract more institutional and individual investors and open the Vietnamese market as soon as possible, EQT VN will organize the project "Vietnam worthy of Asia finance" for Vietnamese investors started from 2023 and is expected to organize two regulations per year.

In June 2023, we successfully held the first phase, and the income of individual investors reached more than 150%.

We will hold the second year of "Vietnam Worthy of Asia Finance" from June this year and the income is expected to reach 280% in 2024

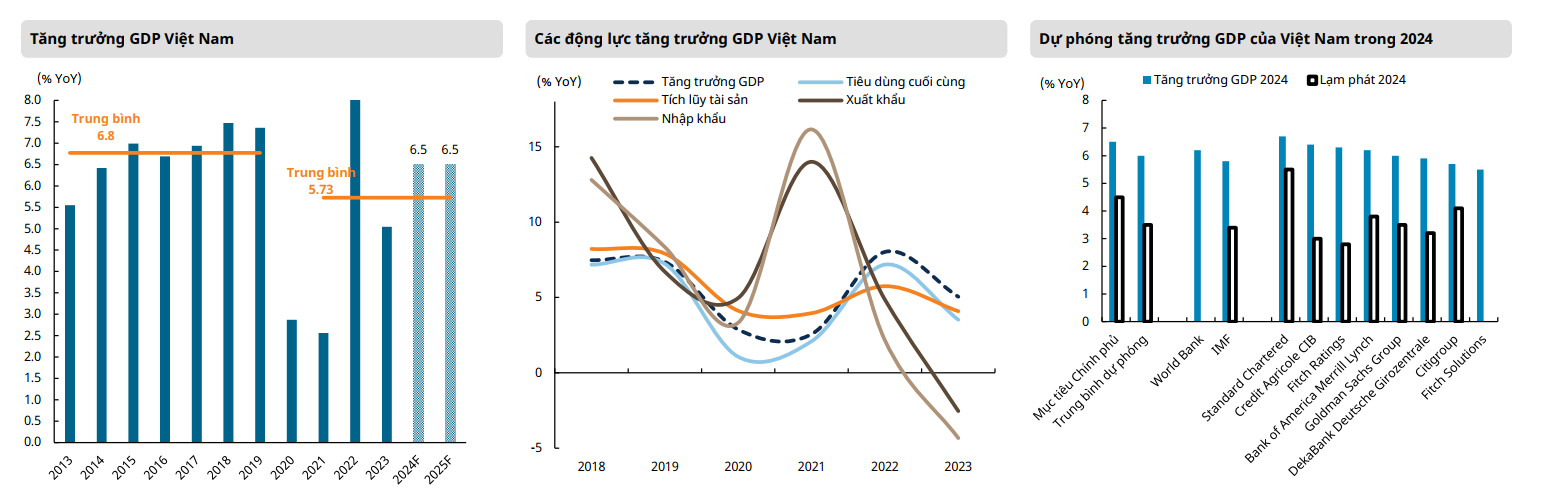

With the successful launch of two quarters of the Vietnam project worthy of Asia Finance, we have full confidence in expanding the Vietnamese market and also see the potential of the Vietnamese market which will have a positive impact. positive for the Vietnamese stock market in 2024. Dorsati Madani, senior economist at the World Bank, predicts that Vietnam's economic growth will gradually recover in 2024. Oxford Economics forecasts GDP in 2024 to increase by 5.6%, while United Overseas Bank-UOB (Singapore) forecasts Vietnam's economic growth rate to reach 6% in 2024 and 6.4% in 2025.

Maybank Research forecasts that Vietnam's GDP growth will recover in 2024 and 2025, at 4.5% and 4.7%, respectively, compared to 4% in 2023, while ING Think forecasts Vietnam's GDP growth in 2024 is 6%, one of the highest growth rates in the region and is expected to increase to 6.5% by 2025.

S&P Global Ratings forecasts that Vietnam'S economic prospects remain positive, with real GDP growth at 5.8% in 2024 and returning to the long-term trend of 6.5-7% in 3 to 4 years. next year.

Both exports and imports will likely return to stable growth in 2024. The current account surplus will remain high, about 5.5% of GDP in 2024, before declining in a long-term trend from 2025.

The macroeconomy is stable and increasingly diversified, with the manufacturing sector booming, mainly thanks to FDI. Vietnam remains an attractive destination for foreign investment, especially in the manufacturing sector, as businesses continue to diversify their operations in the region.

Vietnam as a destination for FDI in Southeast Asia thanks to its young, increasingly educated and competitive workforce, which will help sustain development in the long term.

Vietnam is also considered to be becoming a digital hub, driven by dynamic cooperation between global investors and local technology innovators.

According to the ranking, Vietnam ranks 2nd in digital economic development in the world. According to the World Bank, Vietnam's digital economy is expected to exceed $43 billion by 2025 thanks to its continuous focus on promoting information and communications technology, including AI integration initiatives.

In addition, in the first 6 months of 2024, Vietnam recorded a positive growth of 10.2% since the beginning of the year, far exceeding many markets in the region such as the Bangkok SET index (-8%), Jakarta JCI (-3%) and Philippines PCOMP (-1%)...

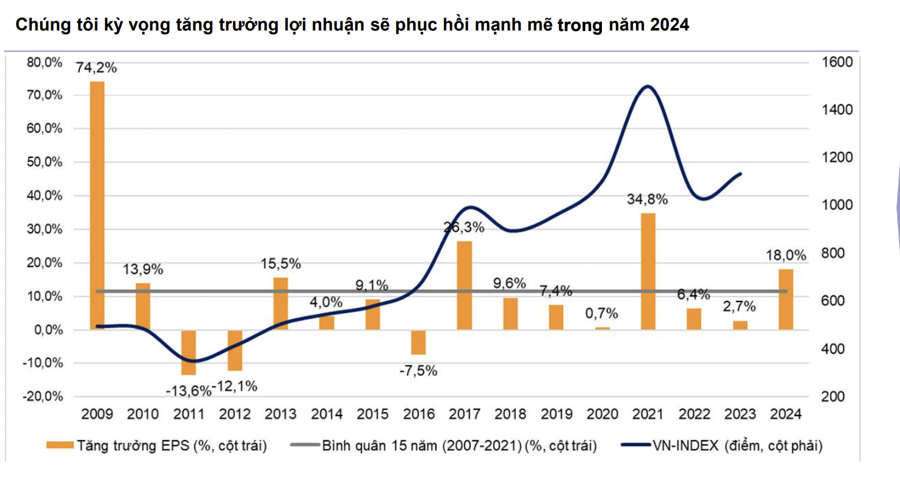

This growth was driven by positive first-quarter profit growth of 11.3% year-over-year for companies listed on the three exchanges; Strong recovery momentum of export and manufacturing activities; The National Assembly passed the Land Law and the Law on Credit Institutions to resolve bottlenecks for the real estate and banking industries.

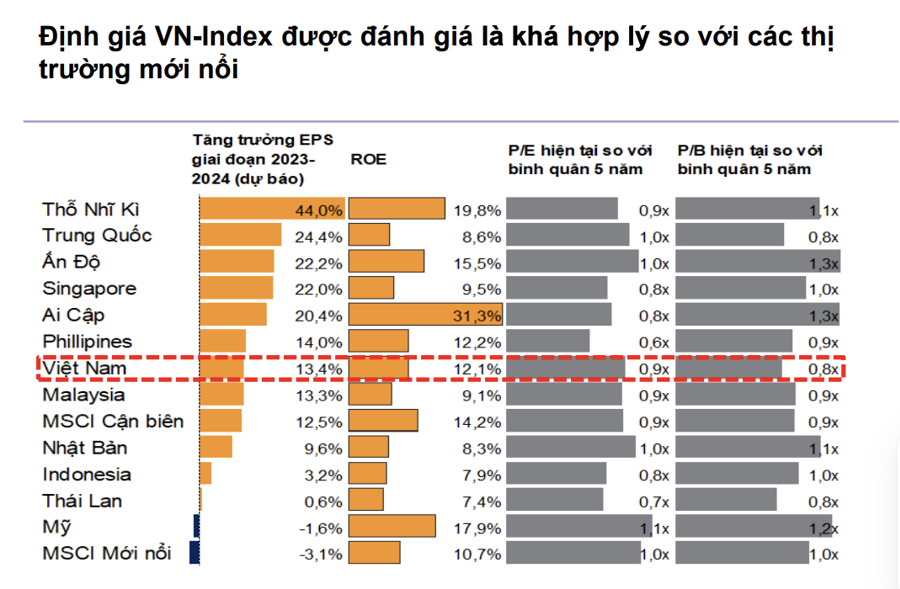

In terms of valuation, VN-Index's P/E is currently still at a reasonable level as it is trading at 2.8% lower than the 5-year average P/E and EPS growth is expected to improve in 2024. VN-Index's 2024 P/E forecast reaches about 13 times. Attractive P/B valuation with a current P/B of 1.7 x at an 18.6% discount to the 5-year average P/B.

VN-Index's valuation is also considered quite reasonable compared to emerging markets. The current P/E stands at 1.1% above the emerging markets average (MSCI EM), while the P/B stands at 1.7 x, equivalent to the average (MSCI EM). However, the ROE of VN-Index has always been higher than MSCI EM in the past 5 years.

In addition, the difference between E/P and current 12-month deposit interest rates is quite large compared to the past, showing that the stock market still maintains its attractiveness compared to the savings deposit channel. VN-Index's E/P is about 7.0% as of June 28, 2024 while the 12-month term deposit interest rate reaches nearly 4.9%/year.

Although deposit interest rates have gradually increased, the profit growth rate of listed businesses in the coming quarters will help the gap between E/P of VN-Index and deposit interest rates remain high. This helps the stock market maintain its attractiveness compared to the savings channel in the second half of 2024.

EQT VN offers three scenarios for Vietnamese stocks at the end of the year, of which the base scenario of the Fed cutting interest rates once in the second half of 2024; DXY drops below 102 after Fed cuts rates; Exports grow 10-12% in 2024; Credit growth will reach 14% in 2024, slightly lower than the SBV target.

VN-Index is forecast to reach 1,330-1,350 points by the end of 2024, up 19% over the same period, 14.2 x P/E with market profit expectations to grow 18%.

Real estate has the highest price increase potential of 38.7% driven by the positive impact of the new land law taking effect from next August. This also supports the steel sector's potential price increase of +35.1%, which has been driven by strong export growth.

The recovery momentum of the real estate industry and abundant FDI capital flows will also help the banking industry group, which has the potential to increase prices by 19.5%, achieve its high credit growth target this year. Besides, with an average P/B of about 1.7 x, the bank's valuation does not seem to fully reflect the forecast ROE.

For 2025, EQT VN forecasts that the Fed is expected to cut interest rates 3 times in 2025; USD strength DXY index weakened following the Fed's interest rate cut trend. Domestically, economic growth continues to improve. Vietnam's GDP is forecast to grow by 6.5-7.0% in 2025, driven by domestic consumption and private sector investment.

It is forecast that the profits of businesses listed on HoSE will grow by 15-17% in 2025 thanks to the positive improvement trend of the economy. VN-Index will reach 1,580-1,600 points by the end of 2025, (14.8 x P/E; ~ equivalent to 5-year average P/E), VN-Index's growth potential is 1718.5%.

Therefore, we have made an important decision to launch the second quarter phase of the project "Vietnam worthy of Asia finance" from July 2024.